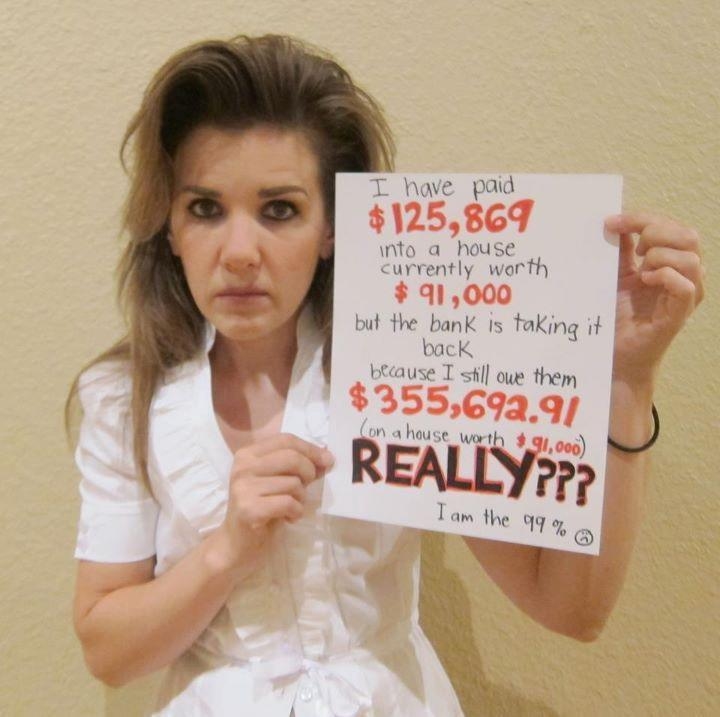

I found this picture in the Occupy Miami Facebook page:

Let’s assume for the sake of the argument that she is from somewhere in South Florida. If the numbers that she is displaying seem unreal, they are not. But she is not being candid about it, allow me to explain.

Let’s assume for the sake of the argument that she is from somewhere in South Florida. If the numbers that she is displaying seem unreal, they are not. But she is not being candid about it, allow me to explain.

About a decade or so ago when my wife and i decided it was time to buy a house, we did what we were supposed to do: Check our finances, check our incomes, credit reports, figure out taxes and ask for a pre-approved fixed rate loan before we went house hunting. The bank approved $120,000 and we had some more saved so we were aiming for a house in the $100 to $110 region. We bumped into a little 3 bedroom/ 2 bathroom house with a lake as backyard in the neighborhood of $120K and we both fell in love with it. Even though other equally designed houses in the same neighborhood were cheaper, the lakefront added a generous chunk to the selling price The wife once again went over the math and said we could do it if we tightened our belts some. We took the plunge and became (with the bank) homeowners.

Then came the housing market craze. Prices started to go up and up and up and people like the dumb ass in the picture got greedy. A dirty little secret about the Miami Housing Boom and Collapse is that the majority of home buyers were not looking for a home but an investment. The smart ones got in early kept the property for a couple of months and then dumped it to the next greedy asshole with the same greedy dream. The other lot wanted a house, but in reality could not afford one but since they were giving away goverment-backed loans like it was candy, they went in anyway thinking that at worst they could sell the house and make a small profit. Everybody was betting that the price hike would never end and they felt secure on taking very stupid chances. At the height of the madness, we had realtors dropping by every week making offers in cash for our house. The last firm offer I had before I got tired and posted a warning sign at the door was for $285,000! In less than ten years, my house went up in price a whooping $160,000. I am not an economic genius by any stretch of the imagination but I knew something had to give and it did

Now I am surrounded by idiots like the one above that gambled on perpetual prosperity and lost. And yes, her house now is valued at $91K because that is what the actual market dictates due to the glut of available houses in the area and lack of buyers. That she bought into an exaggerated and greedy price trying to make her own little greedy profit and now is paying for it is not of my concern.

Checking the county property records, our house value lost a grand total of only $18 with the housing market collapse. It had gone way up in the past and came down with the rest but I think we can take the hit of a box of WallyWorld 9mm in 10 years.

We planned, we were frugal, we did not get greedy, we lived within our means and killed all possible luxuries in order to afford this house. They were greedy, dumb and unprepared. They bitch that greedy banks should have not been bailed out and I agree, but by the same arcade token, nobody should bail their sorry greedy asses either.

And this is my backyard and the reason we paid that bit extra. The way I see it, I am saving a crapload in booze, vacations and antidepressants. The pic was from an old meme titled “where do you blog?” The laptop is showing ForScore IDPA software (I was doing the scores for that day’s match), and wanted to do some bullet casting after.

Same here. The wife and I had to move and thought a house would be a smarter move than to continue to rent. You see our landlord wanted out of the property so they decided to sell our unit as a condo. We went to the bank and got pre-approved. Turned out it didn’t make sense to buy our “Apartment”….since we still had the approval, we went house-hunting and found nothing of interest in our price range. So we got another apartment and saved our monies, when the Market crashed we had our pick and are now quite comfortably paying off our fixed interest loan.

Besides flippers and people who assumed the bank wouldn’t approve them if they couldn’t make the payments, so didn’t do the math themselves….there are lots of people who took out equity lines as the house went up in value and used it as household income or vacations or toys rather than improving the home and property (which makes perfect sense) so when the market crashed they were stuck in the same pit of greed and stupidity as Miss Mascara was.

She Who Lets Me Make Her Coffee Every Morning owned a 1,250 sq. ft town home when we married. I lived in an apartment.

We lived in that cracker box sized home for nearly two years while we paid off a little debt, saved money and searched for a home.

We figured out how much house we could afford with one person working full time at their ‘normal’ job and 1 person either out of work or working part time for minimum wage — then bought a house for slightly less than that.

We also made sure to purchase a house for less than what it was on the market for — I’ve taken to heart that you make a profit in real estate on the purchase, not the sale.

Housing market in the area hasn’t swung out of control, last year the market dropped only 3%.

What I don’t get is why people like her are surprised the bank wants her to live up to her part of a contract. She would have been more than willing to take the profit in good times, right?

I only pulled the trigger on my home purchase because the *fixed rate* mortgage payments – including the tax and insurance escrow payments – were less than I was paying in rent at the time for the same amount of space – and rent rates in the area were only expected to go up as the university planned to keep increasing class sizes.

My overall expenses are about the same, maybe slightly higher (I’m driving farther to work so I pay more in gas), but I’m still better off because of the added stability. I also don’t have to deal with the student population and parties that go until 3am.

And the house? I got what I could afford. Which in my case means a house with 2 bedrooms and 1 bathroom that was built in 1942 and has less than 750 sq. ft. of living space. I’m still better off, and I can actually afford what I got.

She needs to STFU about paying almost half a million she couldn’t afford for a house that’s worth what mine is. She did it willingly, why should I have to pay for her stupidity?

Hell we bought a 1100sq ft. condo with what we could afford – and the greedy bastards who overreached and in crashing caused MY property values to plummet now want to be bailed-out. F* that.

http://xkcd.com/616/