You can tell that the recession of 2022 is going to be bad. The media is rolling out the narrative that inflation is caused by anything but the Democrats policies.

A couple of years ago there was a massive wildfire. The west coast of the US was burning. But when you looked at it from space there was a strange thing happening. The fires stopped at the US/Canadian border. Why?

Policies.

While in the US the econazi’s screamed over anything humans did that changed a single bit of nature, the Canadian’s were practicing better (good?) forest management. The environmentalist in the US had initiated a number of policies that caused the forests of west coast to be turned into one great big tender box.

Different policies get different results.

Of course the media was screaming the leftest talking point “Climate change is causing wildfires!”

In the same way Biden’s economic policies are causing inflation. The media claims it is not because of policy but there are things that make you go “Hmmmm…”

Inflation started falling at the end of 2019 and beginning of 2020, it stabilized with a slow climb through 2020. Then in 2021 there is a sharp upward spike. Just what happened in January of 2021?

The left counters by claiming corporate greed. Corporations are pulling in huge profits in 2022, this proves they are greedy.

The first thing to understand is that companies pulling in profits doesn’t mean that there is suddenly a huge pile of money that the board of directors gets to play in. No, it means that the corporation is going to be paying out more dividends.

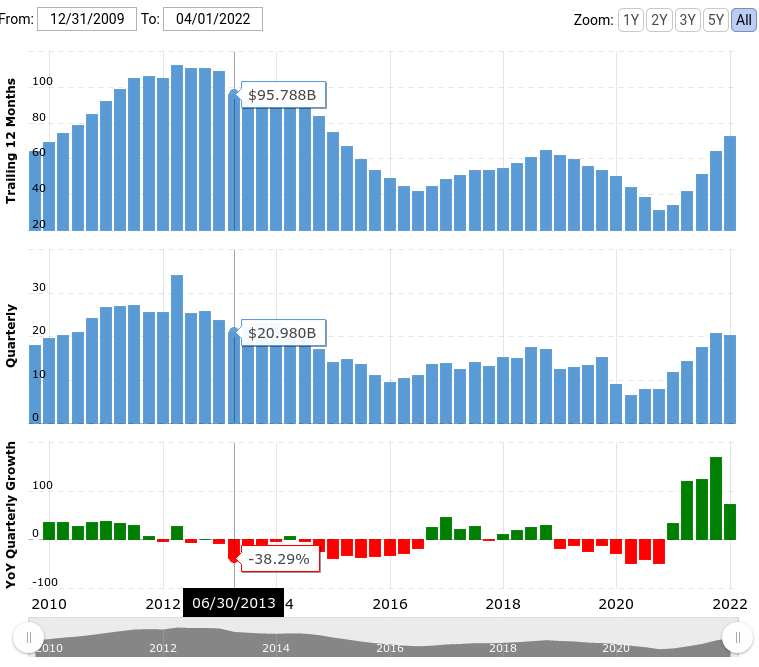

As an example they point to Exxon’s profits, year over year. In the 1st quarter of 2021 Exxon had a profit of $11.824B. In the first quarter of 2022 they had a profit of $20.317B. Obviously this means that the corporations are being greedy.

Except that this is a false comparison. From 2010 through 2012 profits were going up, slightly. From 2012 through 2017 it was going down. 2017 through 2019 it goes back up again. And from 2019 through 2021 it is going down. Then suddenly, in the first quarter of 2021 there is a huge spike in profits. Just what happened in January of 2021?

The short answer is there was a policy change.

The problem with judging “greed” by profits is that profits doesn’t tell you anything about the state of a business. If the gross income on a widget is $100 and the net is $0.10 nobody thinks that’s an outrageous profit. Take that same widget and sell 1,000,000 of them per month and you have a net income of $100,000.

Making $1.2Million in “profits” per year sounds a whole lot better than 10 cents per widget.

People have a difficult time conceptualizing large numbers. A Small Problem With Big Numbers is a brief description of the problems with understanding, getting a feel for, large numbers.

I spent time working for a super computer company. We dealt with very very small numbers in measuring time. Times that were so short that the lengths of wires were all carefully measured because the speed of light made a difference in processing signals correctly.

I was also doing photography. I have some very expensive studio lights.

The lights were fired remotely. When the flash on my camera went off it would trigger all of the studio lights. I was very concerned about synchronization issues. I carefully calculated the time it would take for the light to travel to the sensors, looked up the response time of the sensors and everything else. There was some serious lag involved.

I went to my mentor and asked “How can this possibly work? The lag is horrible.” He carefully pointed out that my lag was measured in nanoseconds. The shutter to my camera was open for 17 milliseconds and the flash only existed for a very short period of time. The lag would have to be nearly one million times larger in order for it to have any effect.

I had failed to grok large numbers.

When dealing with profits most corporations run on slim margins. While the over all cost to you of a good or service might be high, no one entity in the chain of creation is running at unreasonable margins.

When you sell your labor you are competing with every other person with your skillset trying to get that job. If you price yourself out of the labor market then you don’t get the job. If you are asking $100k/year and they are asking $80K/year and they can do the same job, they might get the job instead of you. Unless you bring some extra value.

If the price of a bag of oranges is noticeably higher than a different bag of oranges then you are more likely to buy the lower cost bag of oranges, IFF the quality is good enough.

If the corporations could have raised their prices in 2019 as much as they have today and still sold goods, they would have. They didn’t because their competition would have undersold them. If every seller of oranges is raising their price and nobody is undercutting that implies that people are willing to pay that price and that the seller is unable to cut their prices to get more sales.

Inflation happens when the value of money goes down. Prices go up when demand out strips supply. We are currently experiencing both. The government is injecting more money into the economy which devalues it. The supply for many goods, petroleum products in particular, is going down. Demand is exceeding the supply. Prices will go up.

As our costs go up, we in turn raise our prices to cover those costs. Which in turn raises the costs to those that purchase our goods or services.

We need new policies before we are all billionaires that can’t afford to buy a loaf of bread.

— Workers are being punished for inflation. The real culprit is corporate greed

I remember in history class, back when schools taught history, seeing a photo of a German guy pushing a wheelbarrow overflowing with paper money. Going to try to buy a loaf of bread for his family. America is looking that situation in the eye and it ain’t going to be pleasant. Caused deliberately by demoncrap policies.

There are multiple factors driving inflation here & now. (The key missing factor for Weimar-style hyperinflation is debt denominated in foreign currency; this is the one thing that Carboniferous Monetary Theory gets (temporarily) right.)

Money-printing is an obvious one. But also: supply shortages, and high production costs!

So, we have “money supply expanding faster than the supply of goods and services” being driven from both sides. And, all else being equal, corporate profits will be “up” in terms of being a larger number of smaller dollars.

Clearly, the solution to this is to tax production! Increasing the costs of producing and distributing goods is the One True Way to combat inflation. (At least in Orthanc-speak: “The words of this wizard stand on their heads!” – Gimli)